| | Go To Page: [1][2] 3 |

|

051904-777 |

PPAA18 ***** Tuesday, May 19, 2004 ***** # First Edition

Washington Business and Technology Institute (WBTI)

http://communitylink.reviewjournal.com/lvrj/wbtiAdvisory Board: Governor Kenny Guinn, Chairman; U. S. Senators Harry Reid and John Ensign, Vice Chairmen; U. S. Representatives James Gibbons and Shelley Berkley, and Las Vegas Mayor Oscar Goodman, Executive Directors.

U. S. Secretary of Labor Elaine Chao

Chairperson

Dr. Tony T. Lei

President

District Judges Mark R. Denton and Valorie J. Vega

Vice Presidents

Dr. William N. Thompson

Director of Public Administration Institution

Dr. E. Lee Bernick and Dr. G. Keong Leong

Deans of Graduate School of Business and Public Administration

Dr. Sue Fawn Chung

Director of Culture Institution

Justice of the Supreme Court William Maupin, Attorney General Brian Sandoval, and District Judge Stewart Bell, Honorary Chairmen of Clark County District Attorney and Police Civil Commission (CCDAPCC)

District Attorney David Roger and Clark County Sheriff Bill Young

Chairmen of CCDAPCC

(702) 255-9058

*It's our pleasure to pay a tribute to the above officials who dedicate to the civic and community service aspects of our organization in an honorary or adjunct capacity. -------------------------------------

Las Vegas casino interests open new era in Macau, China

By Rod Smith and GSBPA of WBTI*1 Nevada Governor Kenny Guinn expresses that he can not overemphasize the significance and importance of bringing attention to all the attractions to Nevada at a time when it faces unprecedented competition for gaming customers. He believes that we are wise to expand our marketing efforts and focus on developing markets in places such as Asia.*2 In order to help develop the great market in Asia for our tourism and gaming industry, we are pleased to post, through the courtesy of Las Vegas Review-Journal, the most recent and good news of Nevada's successful entrepreneurship in Macau, China as in the following: Wednesday, May 19, 2004

Copyright @ Las Vegas Review-Journal LV casino interests open new era in Macau

--- Overflow crowd greets new Sands property on opening day*3 By ROD SMITH

GAMING WIRE ***Sheldon Adelson

Plans gaming destination resort complex on Cotai Strip (Please check it with LVRJ.) ***A photographer takes pictures inside the $240 million Las Vegas Sands casino and entertainment complex that opened in Macau.

Photo by THE ASSOCIATED PRESS (Please check it with LVRJ.) ***Overflow crowd greets new Sands property on opening day Photo by THE ASSOCIATED PRESS (Please check it with LVRJ.) An estimated 50,000 gamblers and curiosity seekers Monday helped Sheldon Adelson open Macau to "an exciting new era" for U.S. investments in China's multibillion-dollar gaming market.*4 It took just minutes for an overflow crowd of about 30,000 to rush in and pack Adelson's Sands Macau casino after it opened its doors for the first time Monday night. The $240 million, 1-million-square-foot Sands Macau casino and entertainment complex is the first of several U.S.-owned-and-operated casino projects planned to open in the Chinese enclave over the next several years. In addition to the Sands Macau, Adelson, who owns The Venetian's holding company, Las Vegas Sands, plans to develop a $10 billion gaming destination resort complex on Macau's Cotai Strip. Industry sources are calling the opening of Macau to U.S. gaming companies the most significant event for the Las Vegas operators in 25 years because of the size of the potential market. Las Vegas Sands President Bill Weidner said Macau is the most opportune developing gaming environment his company has ever seen. Macau's casinos raked in an estimated $3.6 billion last year, and could bring in nearly $5 billion this year, he said. That would surpass the revenue from Atlantic City's casinos and rival those from Las Vegas' casinos. More than 1 billion people live within an easy plane flight of Macau, he said, and the World Travel Organization estimates that China will grant 100 million worldwide travel visas in 2020, up from 10 million in 2002. "We believe we can help bring a major portion of those (travelers) to Las Vegas," Weidner said. As many as 80 percent, especially high-end players, will have the resources to visit Las Vegas if the bait set in Macau is tantalizing enough, he said. Deutsche Bank analyst Andrew Zarnett said Macau represents a great opportunity for Las Vegas Sands because it is the greatest untapped market today and because Asians love to gamble. "Added to that, it's a great cross-marketing opportunity to entice Asians to The Venetian (in Las Vegas), not just high rollers, but a lot of midmarket players, too," Zarnett said. "That creates opportunities to bring those players to Las Vegas." Ron Reese, spokesman for Las Vegas Sands, said lines before Monday's opening stretched from the new casino's front doors to the ferry terminal, a distance equivalent to the Strip from The Venetian's porte cochere to the Bellagio. No reports on the actual volume of play in the casino were available late Tuesday, although one Las Vegas gaming source said an estimated 50,000 people visited the Sands Macau during its first day of operation. Industry sources in Las Vegas and Asian media also described near-riot conditions as security agents tried to control the unexpected crowd, tempted in part by incorrect reports that players would get free casino chips. Industry experts said the potential for Macau, which is just off the Chinese mainland, surpasses even the recent performance of the China economy, which grew at an average rate of 14 percent over the past decade. Some estimate China's gaming market could soon amount to hundreds of billions of dollars, compared with the U.S. market, which was just less than $70 billion in gaming revenues in 2002. Adelson was one of two U.S. operators, along with Las Vegas developer Steve Wynn, who were awarded gaming concessions by China authorities two years ago, ending Macau casino magnate Stanley Ho's nearly 50-year monopoly on the former Portuguese colony's gambling market. "It's fortunate we own the concession. It's our vision to develop a (Las Vegas-style) Strip," Adelson said. The top management at The Venetian said the key to the development, and its real value, lies in the allure it will create for Las Vegas and the added visitors it will bring here. Weidner said the Macau development in the long run will both breed new customers for Las Vegas and help China compete for visitors with other destinations in Asia. "Our vision was to literally build a version of the Las Vegas Strip on the doorstep to China," he said. Adelson's new resort is just the first phase of a planned project to turn a 700-acre strip of reclaimed land in the Special Administrative Region into a huge resort complex of several hotels and casinos that will be patterned after the Strip. His plans include working with at least five other hotel developers who will build and operate about 20 hotels, while his company will build and operate accompanying casinos and showrooms, including one that will be a replica of The Venetian. It took 4,000 construction workers to build the Sands Macau, and ultimately the Cotai Strip will employee 150,000 workers, almost doubling the total work force of Macau, Las Vegas Sands Executive Vice President Brad Stone said. "We're creating whole new industries: laundry, produce, meat," he said. "It's a huge undertaking for a relatively small community." Weidner said the business models for the developments in Macau differ somewhat. The Sands Macau was developed to serve today's visitors to Macau, which Weidner likened to downtown Las Vegas or Reno, and feed customers into The Venetian, which already gets 42 percent of its qualified table play from Asia. "The Cotai Strip will be developed around tomorrow's Macau. It'll look more like Las Vegas with more guests staying over several nights. We see it developing more like the Strip," he said. The business plan for The Venetian in Macau, part of the first phase of the Cotai Strip, will be similar to the business plan for The Venetian, Weidner said,. "Demand in Macau is weekend and holidays. It's midweek that Macau can use demand help (with), so we'll develop convention and meeting rooms in order to bolster visitation and occupancy to the Cotai Strip," he said.*5 -----------------------------------------

References *1. GSBPA of WBTI is the initials of the Graduate School of Business and Public Administration (GSBPA) of Washington Business and Technology Institute (WBTI).

*2. GSBPA of WBTI. 'Freedom, Democracy, Judicial ruling, and Entrepreneurship,' "PPAA18 of WBTI," (May 5, 2004), Las Vegas, Nevada: WBTI website.

*3. LVRJ. 'LV casino interests open new era in Macau --- Overflow crowd greets new Sands property on opening day,' "Las Vegas Review-Journal," (May 19, 2004), Las Vegas, Nevada: reviewjournal.com.

*4. Ibid.

*5. Ibid. 77777777777777777777

77777777777777777777777777777777

777777777777777777777777777777777777777777777

************************************************** | |

|

050604-business |

BUSINESS, COMMUNITY, AND SOCIAL WORLD

***** Thursday, May 6, 2004 #First Edition

Washington Business and Technology Institute (WBTI)

http://communitylink.reviewjournal.com/lvrj/wbti

88%88%88%88%88%88%88%88%88%88%88%88%88%88%88% ------------------------------

GAMING OUTSIDE LAS VEGAS: Gambling on Macau

--- Coming Sands opening to end longtime island monopoly

By Rod Smith Thursday, May 06, 2004

Copyright @ Las Vegas Review-Journal*1 GAMING OUTSIDE LAS VEGAS: Gambling on Macau

Coming Sands opening to end longtime island monopoly*2 By ROD SMITH

GAMING WIRE Sheldon Adelson(For his photo, please check LVRJ)

Steve Wynn(For his photo, please check LVRJ) Gaming magnate Sheldon Adelson's 1-million-square-foot Sands Macau casino and entertainment complex, which is leading a wave of new casino developments off the coast of China, is expected to open May 18. The $240 million Sands Macau will be owned by Adelson's holding company, Las Vegas Sands, and will have 319 table games, 600 slot machines, 18 restaurants, bars and entertainment venues located near the ferry terminal in Macau. Las Vegas Sands President Bill Weidner said the Sands Macau will give a face lift to Macau, which he compared to downtown Las Vegas or Reno. He said the growth of China, whose economy has been growing at more than 14 percent a year over the past decade, is driving the development of Macau as a visitor destination. "China is the fastest-growing major economy in the world, and the fourth-largest export economy in the world," he said. It boasts the fastest-growing and second-largest middle class, which is rapidly becoming the largest middle class of any country in the world, Weidner said. He said with about 1.4 billion people within a couple hundred miles of Macau, the island is also destined to become one of the biggest and fastest-growing visitor destinations anywhere. Las Vegas Sands plans to use the market to compete with other Asian destinations and to lure more visitors to its properties in Las Vegas, Weidner said. The opening of the Sands Macau casino will break up a monopoly on casino operations in Macau that Stanley Ho, 82, and his gambling cronies have enjoyed for almost 50 years. Two years ago, authorities approved breaking the monopoly on casino operations by awarding gambling concessions to three groups -- Adelson, Las Vegas-based Wynn Resorts and Ho's group of companies. The Sands Macau is next to the $60 million Galaxy Waldo Hotel-Casino, a smaller property with 38 tables and 100 slot machines being developed by Galaxy, a company started by Hong Kong property tycoon Lui Che-woo, who shares a casino license with Adelson. It is run by Francis Lui and is set to open in June. A $122 million waterfront entertainment and retail complex called Fisherman's Wharf is being built on the other side of Adelson's casino by Ho and David Chow, his partner, and is set to open before year's end. Las Vegas developer Steve Wynn is also planning to build a $500 million hotel-casino, which is expected to open in 2006, although he is hoping for reforms to the enclave's gambling laws before he commits further. In addition to opening the Sands Macau next to the ferry terminal, Las Vegas Sands is obligated to open the Macau Venetian Casino Resort, a second and permanent casino, by June 2006, and invest $550 million in its Macau developments by June 2009. Adelson's long-term plans to develop the $10 billion, so-called Cotai Strip, a strip of reclaimed land between the Macau islands of Taipa and Coloane, includes a 1,500-room resort and casino. He is inviting others to join in building the 20 casinos and 60,000 hotel rooms that will constitute the new Las Vegas Strip East. The Galaxy operation, a group of Hong Kong investors that has teamed up with Adelson, also plans to build a 3,000-room resort casino on separate land in 2006. In all, these projects will require 22,000 additional workers and increase the number of jobs in Macau by about 10 percent. All the development is transforming Macau. The latest boom helped push Macau's economy ahead by a 15.6 percent last year, with growth hitting a 21.1 percent in the fourth quarter. Wynn, who declined to discuss his development, remains the wild card amid this sudden bustle of development. He threatened in August to pull out of a planned venture if Macau failed to enact gambling reforms by the end of last year. It didn't happen, but Wynn didn't make good on his threat to bail out. He is hoping for legislative changes in Macau that would let gaming companies extend credit to gamblers, as well as tax reforms. Macau lawmakers are working on allowing casinos to lend money to gamblers, but one of them, Ng Kuok-cheong, said the bill stops short on tax concessions.*3 ***The Associated Press contributed to this report. --------------------------------

References *1. Through the courtesy of Las Vegas Review-Journal.

*2. Smith, Rod. 'GAMING OUTSIDE LAS VEGAS: Gambling on Macau --- Coming Sands opening to end longtime island monopoly,' "Las Vegas Review-Journal," (May 6, 2004), Las Vegas, Nevada: reviewjournal.com.

*3. Ibid. 6666666666666666

77777777777777777777777777777

777777777777777777777777777777777777777777777 | |

|

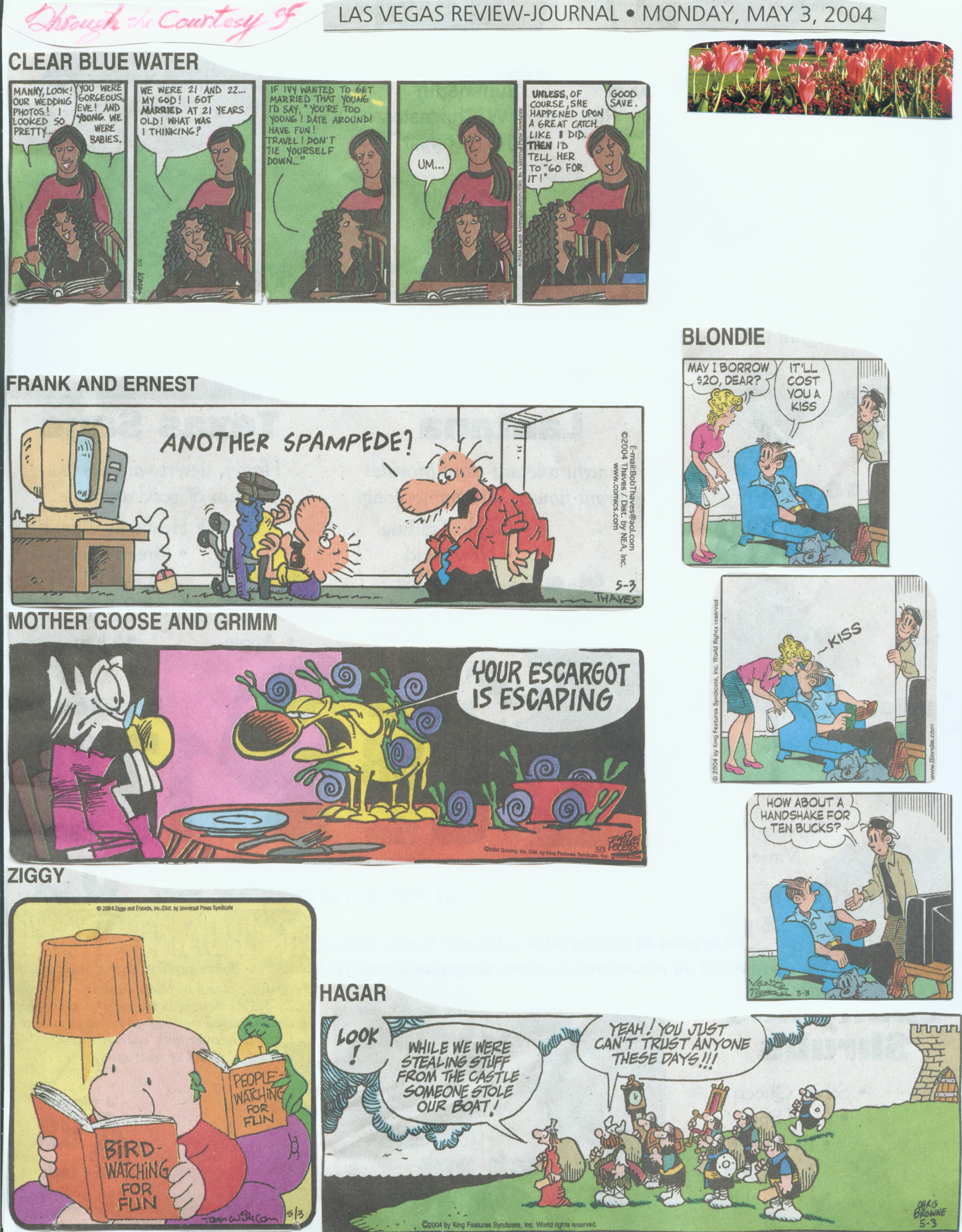

Cartoons may bring us with a sense of humor: |

|

| |

|

Cartoons may bring us with a sense of humor: |

|

|

| |

|

050204-educational papers |

PPAA18 ***** 9:37 a. m., Sunday, May 2, 2004 ***** #First Edition

Washington Business and Technology Institute (WBTI)

http://communitylink.reviewjournal.com/lvrj/wbtiAdvisory Board: Governor Kenny Guinn, Chairman; U. S. Senators Harry Reid and John Ensign, Vice Chairmen; U. S. Representatives James Gibbons and Shelley Berkley, and Las Vegas Mayor Oscar Goodman, Executive Directors.

U. S. Secretary of Labor Elaine Chao

Chairperson

Dr. Tony T. Lei

President

District Judges Mark Denton and Valorie Vega

Vice Presidents

Dr. William N. Thompson

Director of Public Administration Institution

Dr. E. Lee Bernick and Dr. G. Keong Leong

Deans of Graduate School of Business and Public Administration

Dr. Sue Fawn Chung

Director of Culture Institution

Justice of the Supreme Court William Maupin, Attorney General Brian Sandoval, and District Judge Stewart Bell, Honorary Chairmen of Clark County District Attorney and Police Civil Commission (CCDAPCC)

District Attorney David Roger and Clark County Sheriff Bill Young

Chairmen of CCDAPCC

(702) 255-9058

*It's our pleasure to pay a tribute to the above officials who dedicate to the civic and community service spects of our organization in an honorary or adjunct capacity. ------------------------------------------

The recent educational and academic publication of our Grazidio School of Business and Management of Pepperdine University By Tiffany Chang It's our pleasure to post the information about educational and academic study and research of the "Graziadio Business Report" of our Grazidio School of Business and Management. The School is one of the famous and achieved institution in Pepperdine University, Malibu, California, U. S. A..

We are also pleased to share the following information and knowledge with all our friends and faculty members of Washington Business and Technology Institute (WBTI): We are pleased to announce that there is now a new issue online. We invite you to visit the home page at http://gbr.pepperdine.edu/ or to click through to one or more of the features and articles below.*1 Slips, Trips and Falls: A primer for businesses on the law of premises liability

Charles Hunt, J.D.

http://gbr.pepperdine.edu/041/liability.html

Inviting the public into your place of business - or even to walk on the sidewalk in front of your business - carries some risk. What is your responsibility if someone trips or falls down while on your premises? Where are the places that you might need extra security in order to avoid someone being harmed? What kind of practices will provide you with a good defense should something happen? (Hint: Proactive safety measures as a routine part of business are a good idea!) To see what else might be helpful, read Charles Hunt's primer on liability. The Dollar vs. the Euro: How low will it go?

Peggy Crawford, Ph.D., Terry Young, Ph.D. and Julia Takhtarov

http://gbr.pepperdine.edu/041/devaluation.html

The fall of the dollar against most of the world's currencies over the past year requires that businesses consider another layer of complexity in making plans: How will the price of imported parts or goods (including oil), be affected by the slide of the dollar and how will that affect my business? On the other hand, can I sell more abroad if American goods cost less overseas? The authors tackle these questions, with a particular focus on the relationship of the dollar to the euro. Currency Exchange Quiz

http://gbr.pepperdine.edu/041/quiz.html

When you have finished the article, or maybe before, you can try your hand at the Currency Exchange Quiz. It is an interesting way to see how well you understand the concepts - and no one even knows your score unless you want to brag. Slowing Runaway Juries: Court decisions provide new guidance for punitive damage awards

Larry Bumgardner, J.D.

http://gbr.pepperdine.edu/041/punitive.html

Businesses facing a lawsuit over some alleged product defect or improper behavior often fear that they may face punitive damage awards in the millions or even billions of dollars imposed by juries determined to "send a message." A recent Supreme Court decision provides corporate defendants some hope of relief. Find out what the guidelines now are based on a recent Supreme Court decision. Using Conflict to Your Advantage: Butting heads is not always bad.

Teri C. Tompkins, Ph.D., and Kathryn S. Rogers, Ph.D.

http://gbr.pepperdine.edu/041/learningteams.html

Based on an in-depth study by Tompkins of work teams in the aerospace industry, the authors provide a four-stage process for teams that want to grow into effective learning teams. They show that while conflict is endemic in organizational life, it need not always be negative. Those working together must understand the basic principles of how to use conflict to facilitate becoming a learning team that increases its capacity to take effective action through diffusion of knowledge and skills. Wired! Hong Kong, China, and Japan flex their electronic muscles

Mark Chun, Ph.D. and Charla Griffy-Brown, Ph.D.

http://gbr.pepperdine.edu/041/itinfrastructures.html

Whether your business is B2B or B2C, if you are planning to visit or do business in China, Japan, or Hong Kong you need to understand the nature of the electronic infrastructure and whether or not you will be able communicate in the same way you are used to doing back home. Chun and Griffy-Brown provide an overview of how these infrastructures have developed and what you can expect. They also point out the need to understand the cultural expectations that will also be there. Merging Successfully: The importance of understanding organizational culture in mergers and acquisitions

Kent Rhodes, Ed.D.

http://gbr.pepperdine.edu/041/mergers.html

Mergers and acquisitions as a growth strategy seem to be coming back into vogue. In this article Rhodes warns that creating a new company is not as easy as it may appear on paper. However he doesn't stop there. He identifies particular problems and then strategies to deal with the most elusive, but critical, element of the new company -- its culture. A Conversation with Tom Ross:

CIO and Vice President, Information Systems Division of American Honda

Mark Chun, Ph.D.

http://gbr.pepperdine.edu/041/conversation.html

Professor Chun, who teaches in the area of information systems, talks with Mr. Ross about the Honda culture, about the issues involved in moving from a technical position to managing a business, and the importance of real communication for a successful business operation. Don't Panic: Try the way of the trout

Charla Griffy-Brown, Ph.D.

http://gbr.pepperdine.edu/041/editor.html

The always-creative Dr. Griffy-Brown helps us understand the importance of being focused and constant, even in turbulent times. Using a number of metaphors from the sea and its life, she provides some good suggestions for business practice - along with introducing this issue of GBR. The Book Corner

http://gbr.pepperdine.edu/041/books.html

The response to this new feature was very positive in our last issue. We are therefore pleased to bring four new suggestions for books. This time the range of topics is broad, but we believe that you will find all of these very worthy of your consideration. We have added a new feature where you can click directly through to Amazon and order the book if you like. The Arcade: Consumer Credit Calculators

http://gbr.pepperdine.edu/041/arcade.html

Instead of a strictly business software package this time, GBR brings you some calculators that may help you sort out your own personal financial situation. In a time when many jobs have been lost to downsizing, or when people have decided to try their hand at consulting or beginning a new business, financial decisions are critical. You can use these calculators to help figure out your situation. And if you find that you are already swimming in those turbulent waters that Dr. Griffy-Brown writes about, then there are suggestions here for you as well. We hope that you find this issue of the Graziadio Business Report informative and valuable. We also invite you to pass this message and information about GBR along to your colleagues and friends. ------------------------

References *1. Graziadio School of Business and Management. 'Graziadio Business Report: The latest issue of the Graziadio Business Report is now online!' "An e-mail to Dr. Tony Lei from the Grazidio School of Business and Management, Pepperdine University," (April 27, 2004), Malibu, California: Pepperdine University.

*2. Ibid. 7777777777777777777777777

88888888888888888888888888888888

999999999999999999999999999999999999999999999

************************************************ | |

|

050104-Management programs |

Public Services ***** Saturday, May 1, 2004 ***** #Second Edition

Washington Business and Technology Institute (WBTI)

http://communitylink.reviewjournal.com/lvrj/wbtiAdvisory Board: Governor Kenny Guinn, Chairman; U. S. Senators Harry Reid and John Ensign, Vice Chairmen; U. S. Representatives James Gibbons and Shelley Berkley, and Las Vegas Mayor Oscar Goodman, Executive Directors.

U. S. Secretary of Labor Elaine Chao

Chairperson

Dr. Tony T. Lei

President

District Judges Mark Denton and Valorie Vega

Vice Presidents

Dr. William N. Thompson

Director of Public Administration Institution

Dr. E. Lee Bernick and Dr. G. Keong Leong

Deans of Graduate School of Business and Public Administration

Dr. Sue Fawn Chung

Director of Culture Institution

Justice of the Supreme Court William Maupin, Attorney General Brian Sandoval, and District Judge Stewart Bell, Honorary Chairmen of Clark County District Attorney and Police Civil Commission (CCDAPCC)

District Attorney David Roger and Clark County Sheriff Bill Young

Chairmen of CCDAPCC

(702) 255-9058

*It's our pleasure to pay a tribute to the above officials who dedicate to the civic and community service spects of our organization in an honorary or adjunct capacity. ------------------------------

Knowledge, experience, and professionalism with wisdom

By GSBPA of WBTI*1 The modern and creative philosophy of management is advanced on the following words of wisdom, among others:*2 ***"The trees that are slow to grow bear the best fruit." --- Moliere

***"Luck is a matter of preparation meeting opportunity." --- Oprah Winfrey

***"The secret of joy in work is contain in one word -- excellence. to know how to do something well is to enjoy it." --- Pearl Buck

***"Plans fail for lack of counsel, but with many advisers they succeed." --- Proverbs 15 : 22 "Bible" "As a bridge between the business and university, the integrity of community service and academic research of Washington Business and Technology Institute (WBTI) will help Nevada go advance for the cooperation and development in education, business, and culture among international countries. As an Adjunct Associate Professor of the Graduate School of Business and Public Administration (GSBPA) of WBTI, it's my pleasure to extend my knowledge, experience, and professionalism in public service for community and education at the adjunct capacity," said Jackie Glass, District Judge of Nevada, at the event and dinner party by Unity Council of Nevada in Lindo Michoacan Mexican Restaurant on April 28, 2004 in Las Vegas.*3 -----------------------

References *1. GSBPA of WBTI is the initials of Graduate School of Businness and Public Administration of Washington Business and Technology Institute (WBTI).

*2. Chang, Tiffany. 'Some good personal traits for an individual to be successful in business and some golden words of wisdom for positive thinking,' "Newsbrief of WBTI," (April 8, 2004), Las Vegas, Nevada: WBTI.

*3. Glass, Jackie. "A writing paragraph with signature on my appointment by Washington Business and Technology Institute," (April 28, 2004), Las Vegas, Nevada: WBTI. 333333333333333

888888888888888888888888888888888

777777777777777777777777777777777777777777777

************************************************ | |

|

043004-technology |

PPAA18 ***** 1:37 p. m., Friday, April 30, 2004 ***** #First Edition

Washington Business and Technology Institute (WBTI)

http://communitylink.reviewjournal.com/lvrj/wbtiAdvisory Board: Governor Kenny Guinn, Chairman; U. S. Senators Harry Reid and John Ensign, Vice Chairmen; U. S. Representatives James Gibbons and Shelley Berkley, and Las Vegas Mayor Oscar Goodman, Executive Directors.

U. S. Secretary of Labor Elaine Chao

Chairperson

Dr. Tony T. Lei

President

District Judges Mark Denton and Valorie Vega

Vice Presidents

Dr. William N. Thompson

Director of Public Administration Institution

Dr. E. Lee Bernick and Dr. G. Keong Leong

Deans of Graduate School of Business and Public Administration

Dr. Sue Fawn Chung

Director of Culture Institution

Justice of the Supreme Court William Maupin, Attorney General Brian Sandoval, and District Judge Stewart Bell, Honorary Chairmen of Clark County District Attorney and Police Civil Commission (CCDAPCC)

District Attorney David Roger and Clark County Sheriff Bill Young

Chairmen of CCDAPCC

(702) 255-9058

*It's our pleasure to pay a tribute to the above officials who dedicate to the civic and community service aspects of our organization in an honorary or adjunct capacity. ----------------------------------

The reward for work well done is the opportunity to do more

By GSBPA of WBTI*1 The advancing and good work performance by the search engines giants Google.com, Yahoo.com, Infoseek.com, among others has inspired Washington Business and Technology Institute (WBTI) to share the following golden words with its friends and faculty members: ***"The reward for work well done is the opportunity to do more." --- Jonas Salk, MD

***"Those who trust us, educate us." --- George Eliot

***"Few things help an individual more than to place responsibility upon him and to let him know that you trust him." --- Booker T. Washington It is our pleasure to post the most recent information by a feature article through the courtesy of Las Vegas Review-Journal about this modern technology and industry: Apr 30, 9:43 AM EDT Search Engine King Google to Go Public By MICHAEL LIEDTKE

AP Business Writer SAN FRANCISCO (AP) -- Internet search engine leader Google Inc. filed its long-awaited IPO plans Thursday, thumbing its nose at Wall Street's traditions even as the company prepares to cash in on its meteoric success. Without specifying a price per share, Google said it hopes to raise $2.7 billion with an initial public offering that has created the biggest high-tech buzz since the dot-com bubble burst four years ago. The IPO is expected to give Google a market value of at least $20 billion, creating scores of new Silicon Valley millionaires - including many of the company's 1,900 employees. "Feels great!" Google employee Edwina Beaus said as she walked between buildings at the company's Mountain View headquarters - a hub known as the "Googleplex." But even as it prepared to dance with the Wall Street bankers who will take it public, Google warned investors that it won't take its marching orders from the markets. "Google is not a conventional company. We do not intend to become one," co-founders Larry Page and Sergey Brin wrote in an open letter included in the IPO filing. As expected, Google said the price of its IPO will be determined through an auction designed to give the general public a better chance to buy its stock before the shares begin trading, most likely in late summer or early autumn. IPO shares traditionally have been restricted to an elite group picked by the investment bankers handling the deal. Google picked two long-established investment bankers - Morgan Stanley and Credit Suisse First Boston - to manage its populist IPO approach. Although Google's stock won't be sold for several more months, the filing represents a significant milestone in the 5 1/2-year-old company's evolution from a fun-loving startup to a corporate adolescent that will be held more accountable for how it manages its money. Google has done well so far, according to a filing that shined a light on the privately held company's finances for the first time. Depending almost entirely on advertising linked to online searches, Google earned $105.6 million, or 41 cents per share, on revenue of $962 million last year. Google got off to an even better start this year, with a first-quarter profit of $64 million, or 24 cents per share - more than doubling its earnings of $25.8 million, or 10 cents per share, at the same time last year. By going public, Google will be under greater pressure to produce steady earnings growth - an expectation that some executives say leads to shortsighted management decisions. As a public company, "you become sharper in some respects, but it also can cause you to make some decisions just so you can show growth from quarter to quarter," said Steve Berkowtiz, chief executive of Ask Jeeves Inc., a Google rival and business partner. But Google says it won't fall into that trap, striving to remain true to the vision of the iconoclastic Page and Brin, former Stanford University graduate students who founded the company in 1998. In one of its first rebellious steps, Google will refuse to project its earnings from quarter to quarter, according to the letter signed by Page and Brin. "A management team distracted by a series of short-term targets is as pointless as a dieter stepping on a scale every half hour," they wrote. Industry veterans, though, doubt Google will be able to buck Wall Street once it goes public. "After the IPO, they're going to have to think in terms of predictable quarterly results and momentum," said Gordon Eubanks, who took software maker Symantec Corp. public in 1989 and now is CEO of Oblix Inc., a security startup. "You have to have a level of predictability and experience to warrant being a public company." To insulate themselves from outside pressure, Page and Brin are creating a two-class stock hierarchy designed to give them effective veto power. The company is selling Class A common stock to the public, but Page and Brin will control Class B stock, which will have 10 times the voting power. The setup is similar to systems used by several major media companies and Berkshire Hathaway Inc., run by stock market sage Warren Buffett. Thursday's filing didn't spell out how large the founders' stakes will be after the offering, although they are listed as the company's largest individual shareholders. Both are expected to become billionaires after the IPO. Google paid each man $356,556 in salary and bonuses last year. The filing also emphasized that both Page, 31, and Brin, 30, intend to remain Google's hands-on leaders, making all key decisions with CEO Eric Schmidt, a former top executive at Sun Microsystems Inc. and Novell Inc. who joined the company in 2001. Google is already one of the world's best-known brands, with an online search engine that processes more than 200 million queries daily. Despite its rapid success, Google faces an uncertain future as it tries to fend off stiffening competition from two much larger rivals, software giant Microsoft Inc. and Yahoo! Inc., which runs the world's most popular Web site. Through February, Google held a 35 percent share of the search engine market, with Yahoo at 30 percent and Microsoft's MSN at 15 percent, according to comScore Networks, a research firm. "Someone could still come out of left field and blow Google out of the water," said independent technology industry analyst Rick Broadhead. "What they are doing isn't rocket science. Everyone talks about how they have become one of the biggest successes since the dot-com bust, but they still could become one of the biggest flops, too."*3 ----------------------------

References *1. GSBPA of WBTI is the initials of Graduate School of Business and Public Administration (GSBPA) of Washington Business and Technology Institute (WBTI).

*2. Liedtke, Michael. 'Search Engine King Google to Go Public,' "Las Vegas Review-Journal," (April 30, 2004), Las Vegas, Nevada: LVRJ.

*3. Ibid. 333333333333333

6666666666666666666666666666

999999999999999999999999999999999999999999999

***************************************************** | | | Go To Page: [1][2] 3 |

|